If the word ‘tax’ comes to mind when you think of accounting, you’re wrong. Well, 75% wrong. Taxes are 25% of the CPA license exam, and similarly of all accountants only 25-30% focus on taxes. So what do the other 75% do? Look below for a list of Key Accounting Functions, typical Accounting Role Descriptions, and an Accounting Salaries Summary table with average salaries and years of experience.

Accountants (non-tax ones) have three basic roles:

- manage cash coming in and cash going out (operations),

- put all the numbers of the business together to create a snapshot of financial health (reporting), and

- make sure the business doesn’t run out of money (planning).

When you have a good accounting team, your operations flow, you are prepared for bad scenarios, and you have the numbers to plan your next few years. Like a good marriage, good accounting teams are hard to find, but with a little luck and good advice, you too can have one.

Meeting Your Accounting Needs

- The first step is to understand accounting costs and functions (this article).

- The second is to scope out your needs – what is the actual workload? How can you make it more efficient? Is there enough for a full-time role or more than one? (future articles).

- The last step is to plan your accounting department’s growth – how to find where needs and affordability meet, how not to under/overhire or overpay, and how to set yourself up for success (covered in future articles, subscribe not to miss them).

Accounting Salaries & Role Summary

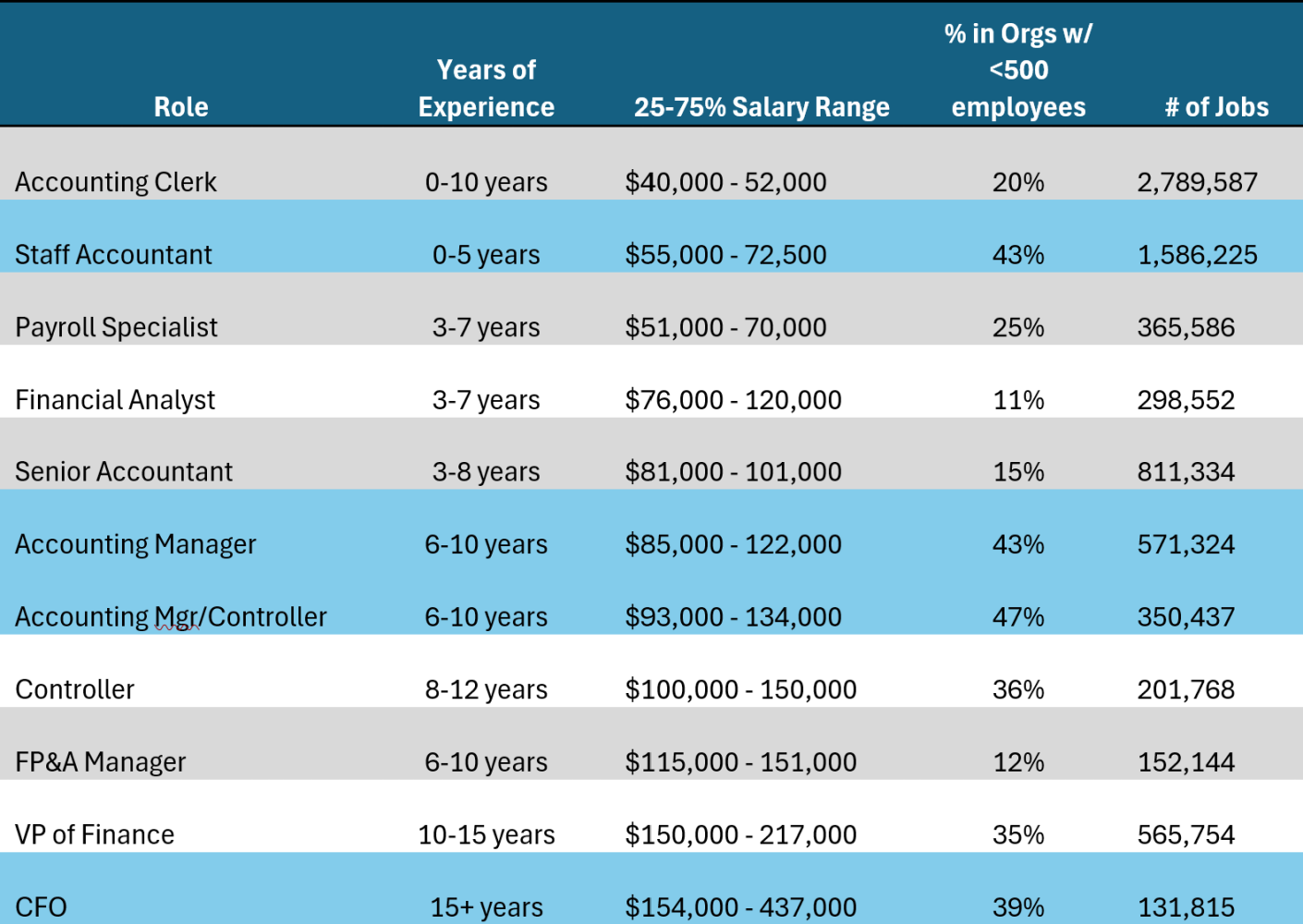

I am starting with accounting department costs because I’m confident that this is the most interesting part of this article. However, role descriptions and duties are included further down. The table below lists 11 most common accounting roles and salaries. They are listed in hierarchical order from lowest to highest. Boy oh boy, those salaries are high!

If you are looking to make your first accounting hire and you plan to only have one, you need someone with a breadth of experience to handle a variety of high level matters; no one lower than Accounting Manager would do, and even this staff will struggle to lead. Most of your workload is simple, but you are overpaying for the occasional scenarios when you need more expertise. That role comes with an average salary base of $100k, all in you’re looking at about $125k (scenario 1). That’s a lot of money to pay for someone who won’t solve all your problems.

Some companies have 3 full-time employees (it’s a common, magic number), the most common combination of roles is Clerk (low level staff), Senior and Controller. This team costs $330k+ annually all in (scenario 2). Yikes!

Light blue rows show roles that are favored by companies with fewer than 500 employees. Salary data is gathered from ZipRecruiter and Zippia, and is based on metropolitan areas in the US.

Should Your Accounting Department Cost 1% of Revenues?

The suggested standard is to spend 1% of revenue on accounting costs. Following that logic, the company hiring an Accounting Manager for a one-person department should earn over $12.5m in revenue. A company hiring a staff of 3 (Clerk, Senior, Controller) should earn over $33m in revenue. What should companies below $12.5m do? They can’t afford a full-time hire. A single full-time hire at Manager level for a $5m company would be at 2.5% of revenue, the % is even higher for a smaller company. For companies with small margins, this is not an option.

Does the 1% rule apply? I am certain that given the use of offshore employees by most outsourced accounting shops and massive leaps in technology, companies >$5m, can keep finance costs below 1%. On the other hand, companies <$5m should be able to keep their finance costs between 1-2%. As a company grows, its accounting department cost should NOT grow at pace with revenues, so the cost/revenue % should shrink. Your accounting team has to be scalable, which means it is able to handle more work as the company grows while staying lean. Next articles will cover what types of hires make sense for different companies.

Accounting Role Descriptions

Basic job descriptions and accountant salaries for the roles listed in the table above are:

1. Accounting Clerk

Average Years of Experience: 0-10 years Average Salary: $40,000 – $52,000 per year

In 5 years, the role might not exist. Accounting clerks handle basic bookkeeping and financial tasks, including processing transactions, maintaining records, and performing routine financial tasks like billing clients or paying vendors. In today’s day and age, with efficiencies provided by software, unless you’re a huge corporation with tens of thousands of bills per month, you don’t need one. If you are not a Fortune 500 and you have a clerk, you’re wasting money.

2. Staff Accountant (prevalent among Small/Medium businesses)

Average Years of Experience: 0-5 years Average Salary: $55,000 – $72,500 per year

Staff accountants are responsible for preparing financial statements, performing month-end closings, and analyzing financial information to ensure accuracy and compliance. In smaller companies, they also handle all the work of an accounting clerk.

3. Payroll Specialist

Average Years of Experience: 3-7 years Average Salary: $51,000 – $70,000 per year

Payroll specialists oversee the processing of company payroll, ensuring all employees are paid accurately and on time, vacation is tracked and benefits while complying with government regulations.

4. Financial Analyst

Average Years of Experience: 3-7 years Average Salary: $76,000 – $120,000 per year

Financial analysts in accounting departments focus on budgeting, forecasting, and helping the company make strategic financial decisions through detailed analysis.

5. Senior Accountant

Average Years of Experience: 3-8 years Average Salary: $81,000 – $101,000 per year

Senior accountants take on advanced accounting tasks such as month end journal entries, accrual tracking, software implementations, regulatory reporting, tax planning, and often supervise junior accounting staff.

6. Accounting Manager (prevalent among Small/Medium businesses)

Average Years of Experience: 6-10 years Average Salary: $85,000 – $122,000 per year

Accounting managers oversee the operation of accounting departments, develop systems for collecting, analyzing, verifying, and reporting financial information.

7. Accounting Manager/Controller (prevalent among Small/Medium businesses)

Average Years of Experience: 6-10 years Average Salary: $93,000 – $134,000 per year

This is a junior hybrid of a Controller role, something between a manager and a controller. This version of the role is most commonly found among small to medium sized businesses who are trying to hire their one-person team, or a junior lead to a small department.

8. Controller (prevalent among Small/Medium businesses)

Average Years of Experience: 8-12 years Average Salary: $100,000 – $150,000 per year

Controllers are responsible for all accounting-related activities within a company, including high-level accounting, managerial accounting, and finance activities.

9. FP&A Manager

Average Years of Experience: 6-10 years Average Salary: $115,000 – $151,000 per year

FP&A managers oversee financial modeling, manage the budgeting process, and analyze financial performance to guide strategic business decisions.

10. VP of Finance

Average Years of Experience: 10-15 years Average Salary: $150,000 – $217,000 per year

This position typically involves leading the finance department while reporting to the CFO, implementing the decisions made by the CFO including: strategic financial planning, and ensuring compliance with financial regulations. There are significant salary variations depending on industry, company size, and location.

11. Chief Financial Officer (CFO) (prevalent among Small/Medium businesses)

Average Years of Experience: 15+ years Average Salary: $154,000 – $437,000+ per year

The CFO is a senior executive with responsibility for the financial affairs of the entire organization, strategizing on pricing, efficiency, profitability, financial planning, risk management, compliance, record-keeping, and financial reporting. At times the HR role reports to the CFO.

Key Accounting Functions

Most people not in the finance field do not have a good understanding of what accountants actually work on. Below is a summary of the top responsibilities accountants have within Operations, Reporting and Planning.

A. Operations:

- Managing bank activity (treasury mgmt)

- Managing payroll

- Paying vendors

- Billing clients and managing collections

- Reconciling various operating software to accounting records

- Monitoring inventory

- Overseeing employee expense reimbursement policies and procedures

- Tracking employee benefits deductions and premium payments

- Controlling purchasing and enforcing policies

- Borrowing money

- Managing equity fundraises

- Tracking fixed and intangible asset investments

- Collecting and filing sales taxes and other tax forms

- Managing the cap table & stock option grants & exercises

B. Financial Reporting

- Recording transactions

- Composing financial statements

- Tracking financial metrics (KPIs) (see prior articles on top KPIs)

- Managing audits

- Reporting to board and investors

- Managing government reporting (for some)

- Liasoning with tax professionals

C. Planning

- Budgeting and forecasting (everyone needs it)

- Sensitivity analysis/scenario planning

- Cash runway tracking

- Managing working capital and planning for major purchases or investments

- Mergers & acquisitions planning

Lookout for next few articles to help you asses and plan for your accounting needs.

About the Author: Olga Bashkatova is the founder of NextStage Advisory LLC, a firm that provides monthly bookkeeping services and CFO-level insights to growing businesses. Our mission is to give founders the confidence to use their financials as a tool. We believe in providing solutions, delivering on time, responding within 2 business days, and we guarantee more financial clarity in 90 days. This newsletter aspires to provide founders with the answers to pressing business problems that are just too tough to find on the world wide web.

Prior Articles

-

IRS Crack Down on 1099 Compliance

large rent payments at 24%… do the math… Oh, and the IRS sent the notice 2 years later +interest +penalties = close the US Budget Gap. The client had, in fact, sent out a 1099 as required, but because the EIN was missing, the IRS flagged this vendor as subject to backup withholding. Perhaps they…

-

Top 5 Financial KPIs for Service Companies

Let’s cover how a service business can use a few financial KPIs to measure its performance, identify the problem sources, and increase profitability.

-

Startup Checklist for Founders and VCs

Startup checklist for assessing and tracking important administrative issues.